The Challenge

Every year, people in the US borrow as much as $184 billion annually from friends and family, according to a 2018 survey conducted by Finder. LendAmi’s goal is to revolutionize such person-to-person loan transfers by making them secure, automated, and easy to track. Knowing the current peer-to-peer money lending scenario, LendAmi sensed an opportunity that would enable its customers to serve themselves. They wanted to create a process to ensure that all personal and professional transactions are documented properly avoiding risks related to verbal agreements.

Their requirement was a simple, secure, and stable Web-based portal for peer to peer online loan transfers, trackable in a single place. Complicated features and processes like loan requests, loan modifications, and loan cancellations were to be made not only easy and seamless but secure, with integrations to personal bank accounts. Understanding the involvement of legal regulations and compliance, LendAmi’s main focus revolved around security, maintenance of individual’s bank details and privacy of user data.

Solution Proposed

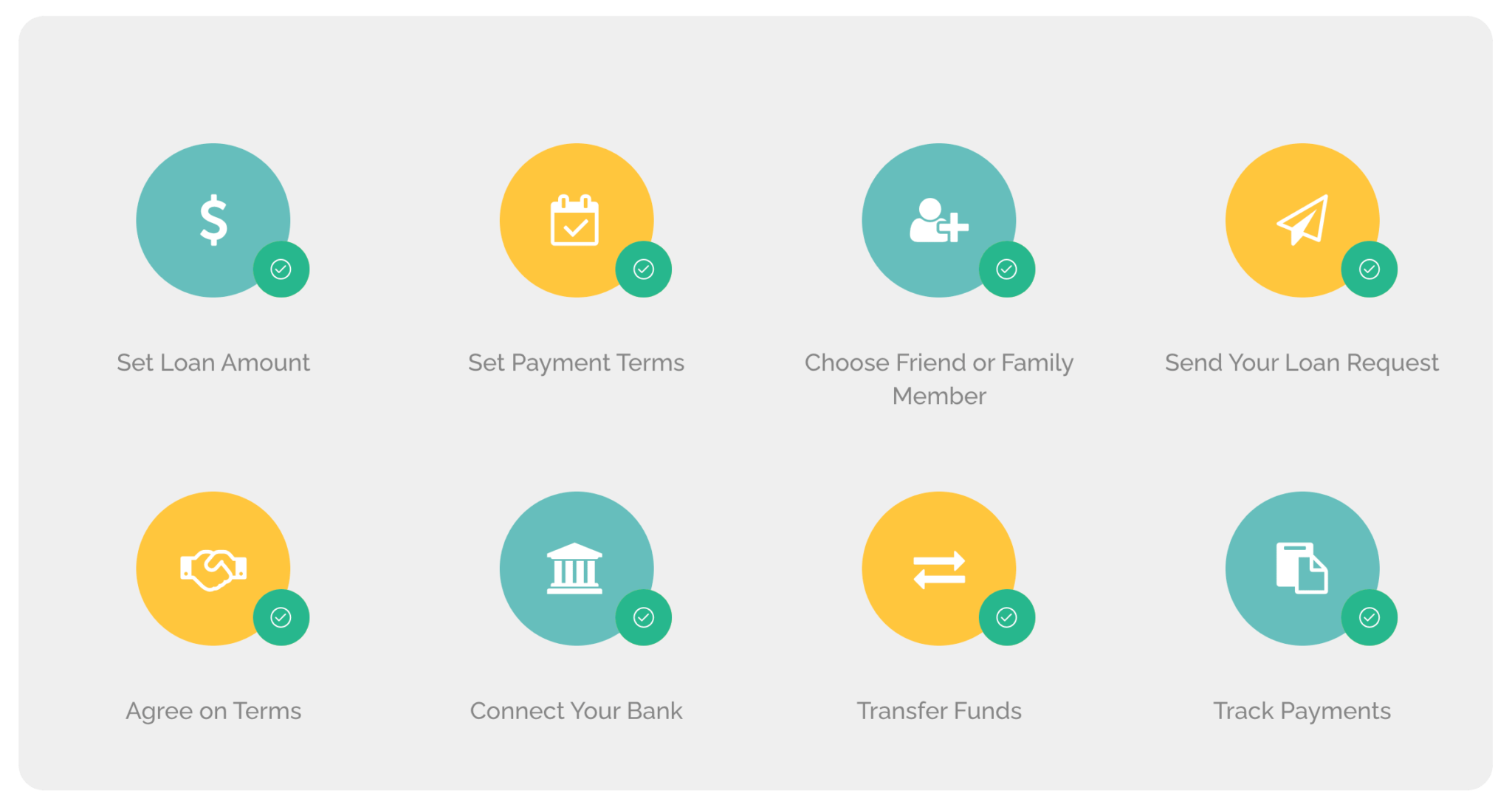

SourceFuse developed a one-of-its-kind, multi-tenant Progressive Web Application that can help a lender or borrower go through a step-by-step process to complete a certain loan transaction. The process puts the user in control of choosing individual loan terms that are right for them, sending their request or offer to a friend or family member and then transacting the loan securely. Here’s how the online loan process flow advances:

Source: LendAmi

Leveraging an iterative approach to manage risk and information security, we focused on integrating applications that strictly protect data when people/ businesses borrow or lend money via LendAmi.

For providing a secure yet intuitive method to connect with the user’s bank accounts for loan transfers, SourceFuse integrated Plaid, an application that leverages security practices that are designed to meet or exceed the industry standards that banks and leading technology companies use.

With data as precious as financial information, we had to make sure only the right people have the right access. Hence, for an efficient and secure transaction, SourceFuse worked with Dwolla, an application that facilitates initiating automated payments excluding the associated high transaction fees.

Alongside automated loan transfers, the requirement of a user-friendly portal with intuitive user experience played a critical role. Since the entire application was centered around specific steps taken in sequence, it was proposed to be modelled as Business Process Model Notation (BPMN) driven. The BPMN tool chosen was Camunda, which made application enhancements easier with a minimum time to market. The logging of all loan transactions was also recorded automatically by the Camunda engine and persisted for any debugging later.

The user interface of the application was optimized for high performance, keeping the application stable during multiple online loan transactions. On its end, LendAmi keeps a track of each loan transaction, reporting both the lender and the borrower of the transaction updates in real time.

Application Features

As a person-to-person platform that helps people lend and borrow from each other safely, securely and responsibly, LendAmi does a seamless job. The main purpose of the Online Loan App is to avoid risky verbal loans by documenting the loan’s amount, interest and repayment terms. It enables both the recipient and the sender to choose their own terms and track the online loan together, for better clarity.

The Online loan agreement can be downloaded free of cost, printed and signed by both parties if desired. Be it individuals, suppliers & service providers or partner resellers, the application serves a wide variety of users. Adding onto the benefits, the application also enables users to:

- Avoid Gift Tax Consequences

- Save Costs as the transaction fee is as low as an ATM Transaction

- Receive text reminders when payments are due

- Schedule automated payments using bank transfers

- Easily navigate the app on an optimized user interface

- Choose from Automated & Manual Payment Options

About The Customer

LendAmi strives to make person to person loan transfers hassle-free. LendAmi enables transacting and tracking personal loans so that stakeholders from both the borrowers and lenders side experience a secure loan transfer. As part of their loan setup, the user can select the terms and conditions of the loan transfer including the loan amount, interest rate, payment frequency, and add collateral or other special items. LendAmi offers services that help the user avoid risky verbal loans, set up automated payments, download free loan agreements, and follow federal and state guidelines.